The Halal sector is rapidly evolving beyond its traditional focus on food, embracing innovation in ethical technology, sustainable finance, and inclusive growth strategies. This expansion reflects a growing global awareness of Halal principles and their alignment with broader ethical and sustainability concerns.

Halal’s Historical Roots and Modern Expansion

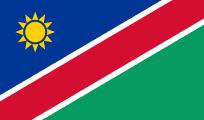

The term “Halal,” meaning permissible in Arabic, has historically centered on food products adhering to Islamic law (Sharia), particularly regarding meat preparation. However, the Halal concept has broadened significantly to encompass finance, tourism, pharmaceuticals, cosmetics, and logistics. This expansion has been driven by a growing global Muslim population and increased consumer awareness of Halal standards – even among non-Muslims who appreciate the ethical and quality assurances Halal certification provides.

Ethical Tech and Halal

The integration of technology is revolutionizing Halal compliance. Blockchain technology, for instance, offers enhanced traceability in Halal supply chains, ensuring products meet stringent requirements from origin to consumer. IoT (Internet of Things) devices are being used to monitor storage and transportation conditions, guaranteeing integrity. This move towards ‘ethical tech’ not only strengthens Halal assurance but also promotes transparency and accountability, appealing to a broader consumer base concerned about ethical sourcing and production.

Sustainable Finance: A Natural Fit

Halal finance, rooted in Sharia-compliant principles, inherently aligns with sustainable and ethical investment practices. It prohibits interest (riba), encourages profit-sharing, and emphasizes social responsibility. This framework fosters investments in businesses that contribute positively to society and the environment. The growth of Islamic finance is providing Sharia-compliant investment opportunities, including crowdfunding platforms and digital financial solutions, which attract investors seeking both financial returns and ethical impact. Key advantages include:

- Ethical Screening: Investments avoid sectors such as alcohol, gambling, and weapons.

- Social Impact: Emphasis on projects that benefit communities and promote social welfare.

- Risk Management: Principles of risk-sharing and asset-backed financing promote stability.

Inclusive Growth and Halal’s Role

The Halal sector is a catalyst for inclusive economic growth, particularly in Muslim-majority countries. It creates opportunities for small and medium-sized enterprises (SMEs) to participate in global Halal supply chains. Halal tourism, for example, supports local businesses by catering to the specific needs of Muslim travelers, including Halal-friendly hotels, restaurants, and tour operators. Furthermore, the demand for Halal-certified pharmaceuticals and cosmetics is driving expansion in these sectors, creating jobs and stimulating innovation.

Challenges and the Future of Halal

Despite the significant growth, the Halal sector faces challenges. One key issue is the lack of universally accepted Halal standards. Varying interpretations of Islamic law across different regions can create confusion and hinder international trade. Greater harmonization of certification processes is needed to facilitate smoother trade flows and ensure consistent standards. Moving forward, expect to see:

- Greater emphasis on sustainable Halal practices, including eco-friendly packaging and ethical sourcing.

- Increased adoption of technology to enhance Halal compliance and traceability.

- Further diversification of the Halal industry beyond food, with growth in sectors such as fashion, media, and entertainment.

By embracing innovation and addressing existing challenges, the Halal sector is poised to drive ethical tech, sustainable finance, and inclusive growth, contributing to a more responsible and equitable global economy.